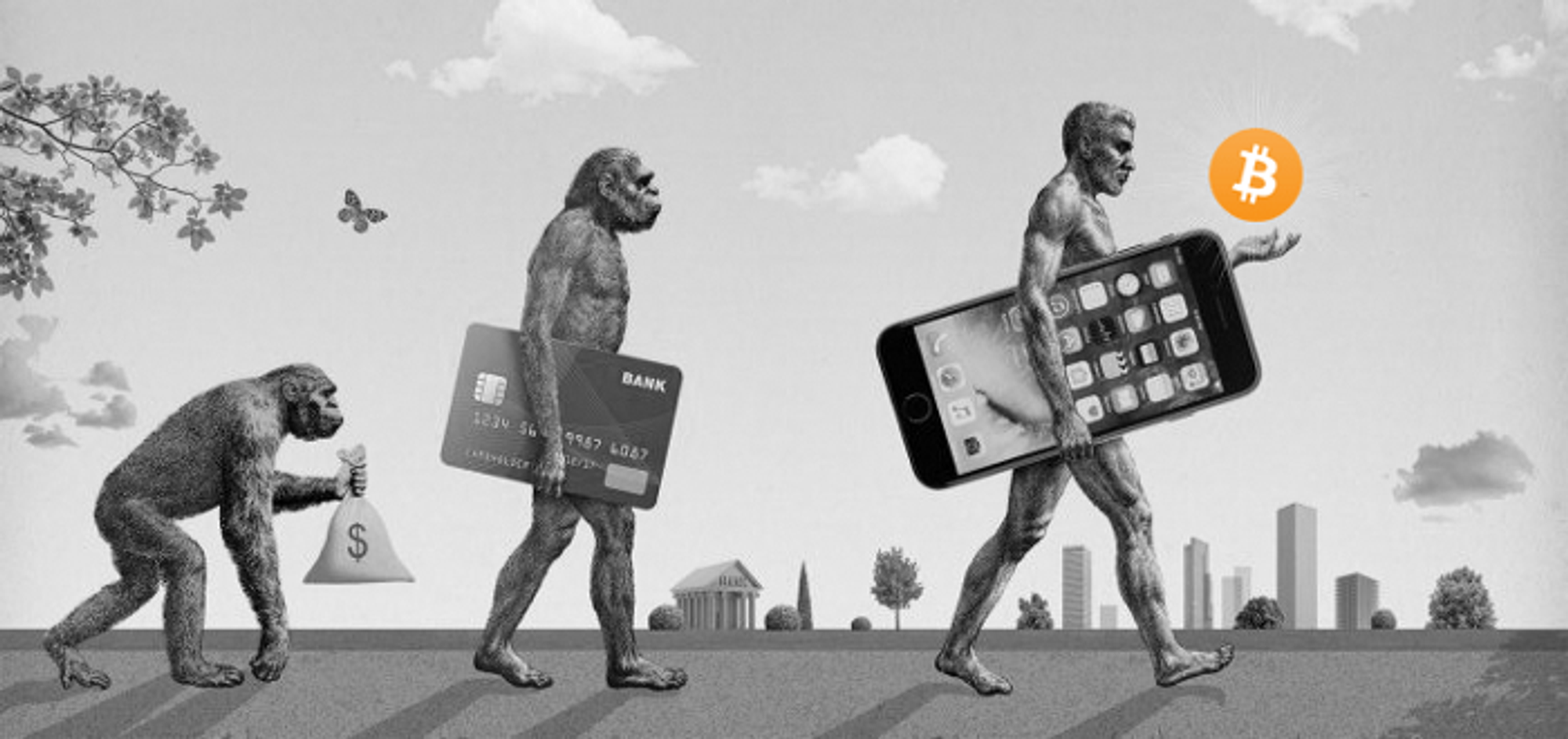

In the fields of banking and economics, cryptocurrency — the digital or virtual money that employs encryption for security — is swiftly changing the game. Due to its decentralized structure, which is made possible by blockchain technology, cryptocurrencies are a desirable replacement for conventional fiat currency.

As more and more people and organizations use digital currencies like Bitcoin, Ethereum, Litecoin, Polygon, Polkadot, Solana, or BNB, it is becoming clearer how cryptocurrency is disrupting traditional financial systems.

Cryptocurrencies’ decentralized and borderless nature enables quicker and less expensive cross-border transactions as well as the possibility of broader financial inclusion for the unbanked people. It is now a breakthrough technology that merits attention since it has caused a change in the way we see and utilize money.

The invention of cryptocurrencies can be attributed to the development of Bitcoin in 2009 by a person or group of people operating under the pseudonym Satoshi Nakamoto. As a response to the financial crisis of 2008, the first decentralized digital currency, Bitcoin, was developed with the goal of offering a decentralized and transparent alternative to conventional fiat currency.

Many other cryptocurrencies, including Ethereum and Litecoin, emerged in the aftermath of the publication of the Bitcoin whitepaper, ushering in a new age in the financial sector.

The cryptocurrency market has experienced incredible growth, with its entire market capitalization exceeding $3 trillion in November 2021.

In recent years, there has been a substantial change in how conventional institutions see cryptocurrencies. Major corporations like Tesla, Square, and MicroStrategy have made significant investments in Bitcoin and other cryptocurrencies, while payment juggernauts like Visa and PayPal have started to provide services connected to cryptocurrencies. Traditional financial companies have also begun to provide their clients with bitcoin trading and custody services, like Goldman Sachs and JP Morgan. This widespread usage of cryptocurrencies shows their increasing legitimacy and adoption potential in the future.

Let’s dive in and explore how crypto is disrupting traditional banking:

1. Lower transaction costs are one of cryptocurrency’s main advantages over conventional banking systems. Traditional banking systems frequently use middlemen, such banks and payment processors, who demand large transaction costs. Transaction expenses are greatly reduced when using cryptocurrencies since they may be completed directly between peers. This makes it possible for micropayments and other use cases that would be unfeasible with conventional financial systems, which may ultimately result in considerable cost savings for individuals and enterprises.

2. Transactions are completed with more speed and efficiency thanks to cryptocurrencies, which is another benefit they have over conventional banking systems. Particularly for cross-border transactions, traditional banking systems might take days or even weeks to execute a transaction. Contrarily, cryptocurrency transactions may be executed anywhere in the world in a matter of minutes or even seconds. The decentralized and digital nature of cryptocurrencies makes this feasible by enabling quicker and more effective transaction clearing and verification. This functionality might be helpful for people, businesses, and e-commerce in general.

3. Cryptocurrency operates on a decentralized system, meaning it’s not controlled by any one institution or government. Unlike traditional financial systems that rely on centralized institutions, such as banks, to manage and process transactions, cryptocurrency transactions are recorded on a distributed ledger (blockchain) that is open and accessible to anyone. This decentralization allows for greater transparency and security as it reduces the potential for manipulation, fraud and cyber-attacks on a single point of failure. Additionally, it also reduces the dependency on governments and central banks, giving more power to the individuals to control their own finances.

4. When compared to traditional banking systems, cryptocurrency transactions are more secure and fraud-resistant because they are protected by sophisticated cryptography. This is because the transactions are decentralized and recorded on a public ledger, which makes it harder for hackers to alter the data. A complicated system of private and public keys is also used by the majority of well-known cryptocurrency wallets to guarantee that only authorized users may access the cash. Especially for big sums of money or international transactions, this makes it a considerably safer alternative for people and corporations to store and move their monies.

5. Potential for broader financial inclusion: Due to lack of bank access, exorbitant fees, and onerous procedures, traditional financial institutions frequently exclude sizable populations, particularly those in developing nations. However, cryptocurrency has the potential to give the unbanked people access to financial services. Regardless of their location or socioeconomic position, people may access the same financial services that traditional banking institutions provide by using a smartphone and internet connectivity. Additionally, bitcoin can give those who live in nations with volatile exchange rates more stability by reducing their reliance on native currencies, which are susceptible to inflation. This may significantly affect how much poverty is eradicated and how fast economies are growing in emerging nations.

The challenges of cryptocurrency

The volatility of cryptocurrencies is one of their biggest problems. Since cryptocurrency values may change drastically in a short amount of time, investing in it might be dangerous. A number of variables, such as market mood, news and announcements, and legislative changes, can have an impact on a cryptocurrency’s value. Due to this unpredictability, it may be challenging for people and organizations to plan and budget for the future and less appealing as a choice for widespread adoption. Despite this, many analysts think that as the industry develops and more institutional investors come into the market, the volatility of bitcoin prices will decline.

The absence of regulation for cryptocurrencies is another problem. Varied nations have different rules and regulations governing cryptocurrency, which operates in a mostly uncontrolled environment.

Due to the lack of regulations, it may be challenging for people and companies to determine what is legal and what isn’t, which may also make it less appealing for widespread adoption. It is also more susceptible to fraud, money laundering, and other illegal acts because of the absence of regulation.

Governments and regulatory organisations are starting to take note of the growing usage of cryptocurrencies, though, and are trying to create rules to control its use. These laws seek to safeguard both consumers and companies while also stopping illegal cryptocurrency-related activity.

Hacking and fraud are possibilities on cryptocurrency exchanges, wallets, and other platforms, which might cost people and companies money. This is due to both the difficulty of the technology itself and the absence of monitoring and regulation in the cryptocurrency sector.

It’s critical that people and organizations take the necessary precautions to safeguard their bitcoin holdings, like utilizing secure wallets, turning on two-factor authentication, and maintaining hardware and software updates. Phishing schemes and other fraudulent activities should also be avoided because they are getting more prevalent as bitcoin use rises.

In conclusion, cryptocurrencies are a ground-breaking technology that are revolutionizing how we see and use money. It is a desirable alternative to conventional fiat currency due to its decentralized character, which is made possible by blockchain technology.

Due to its cheaper transaction costs, higher transaction speed and efficiency, decentralized financial systems, enhanced user security, and promise for greater financial inclusion, cryptocurrencies have upset established banking institutions. Nevertheless, despite the advantages, there are also issues that must be resolved, including as price volatility, a lack of regulation, and the danger of fraud and hacking.

It will be crucial for people, organizations, and governments to collaborate in order to overcome these issues and fully utilize this ground-breaking technology as bitcoin use continues to expand and change.

It is obvious that cryptocurrencies have the potential to play a big role in the world economy as their use expands and changes. Cryptocurrencies’ decentralized and borderless nature enables quicker and less expensive cross-border transactions, which can promote global trade and commerce.

Additionally, the possibility of greater financial inclusion may contribute to the eradication of poverty and acceleration of economic development in emerging nations. A clear indication of cryptocurrency’s growing legitimacy and potential for widespread adoption is the mainstream acceptance of it by significant businesses and financial institutions.

Cryptocurrency is expected to impact the future of money and finance, thus it’s critical to monitor its developments and how they might affect the future of the global economy. Time will say.

Thank you for reading and until next time, take care of your money!